As predicted in the forecast for the recent week, liquidity duly returned to the market albeit in the late hours. Both USDCHF and Gold moved in the forecasted direction but only for a short while. Gold actually made a hard move up and a hard move down to cause a false break. AUDUSD & NZDUSD remained loyal to the bears. As another week is upon us, we will be looking towards the fresh setups the new week brings to us. USDCHF makes it into this week as well.

Join My Telegram Channel To Never Miss An Update.

The charts in Focus for the week are EURUSD, USDCHF & USDJPY.

EURUSD

For close to one year now, the EURUSD has been trending lower without any sign of strength to the bulls. Out of the trend down, the market structure has given off the pattern of a falling wedge. It is not the average textbook falling wedge since this one only has two touches of the resistance and support alike. Before the week ended, the bears had driven this pair down again. The room between current market price and wedge support is just about 50 pips.

I’m bearish the EURUSD at the moment but it might encounter buying pressure at wedge support so I will be cautious on this one. Aside that, if it manages to break the support, this pair will encounter further losses.

USDCHF

The correlation between EURUSD and USDCHF is wonderfully positive. So it will be safe to track the moves of both pairs against each other. Last week I was on the bearish side of this pair as it had taken a secure close below last year’s high. It wasn’t long before the market took me out on my trailed stop loss for a small profit as it reversed quite sharply. It found support at 1.0050 which acted as resistance in May and July 2018. However, the USDCHF is not bullish until it is able to maintain another prominent close above last year’s high which is currently acting as resistance now.

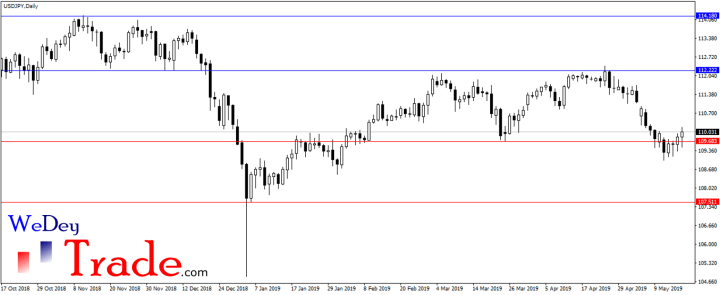

USDJPY.

USDJPY is currently forming signs of a trend reversal. The only roadblock in the way of buyers, if the trend truly reverses is the gap that occurred on 6th May; it wasn’t filled before it headed down. The candlesticks from last Tuesday to last Friday are all pointing signals to the fact that the bulls are trying to pick momentum but they are starting out weak. A close look at the 4 hour timeframe shows that the market is currently establishing higher lows. I will be monitoring this pair closely.

I wish you a profitable trading week.